How Venture Capital Funds Are Structured: A Simple Guide for Emerging Managers

Here’s a plain-English breakdown of how limited partnerships, LLCs, LPAs, and management companies fit together — and why almost everyone ends up in Delaware.

Why Fund Structure Matters

If you’ve ever wondered why so many VC funds are formed in Delaware, or why people throw around acronyms like LP, GP, and LPA — you’re not alone.

Fund structure may not sound exciting, but it shapes how a venture firm operates, raises capital, and protects itself from liability. Understanding these mechanics early gives emerging managers a huge head start.

This guide breaks down the legal building blocks of a VC fund — and how they all connect to create the engine behind venture investing.

1. Limited Partnerships: The Backbone of Every VC Fund

Almost every venture capital fund is structured as a Limited Partnership (LP) — a legal entity made up of at least one General Partner (GP) and one or more Limited Partners (LPs).

This structure defines who controls the fund, who provides the capital, and who takes on liability.

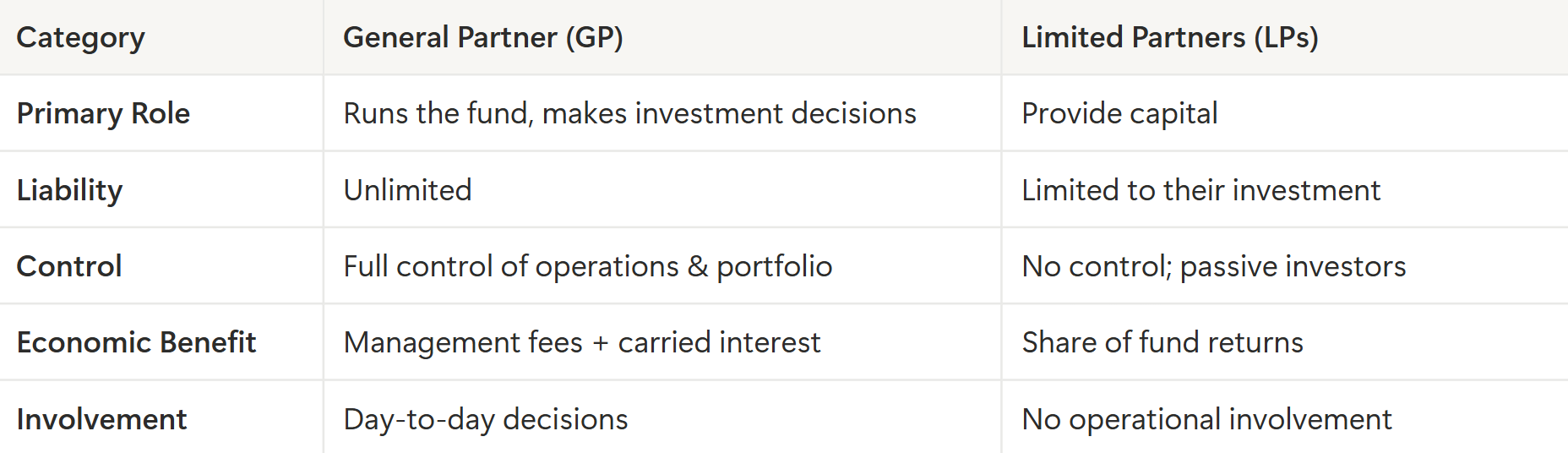

GP vs LP — Roles & Responsibilities:

Why This Structure Works

Limited partnerships are popular because they offer pass-through taxation (IRS: Partnership Taxation Overview) — the partnership itself doesn’t pay taxes. Instead, each partner pays taxes on their share of the profits directly. This avoids the double taxation that corporations face.

Put simply:

LPs provide the capital.

GPs run the fund.

LPs can’t lose more than they invest.

GPs take on the operational risk.

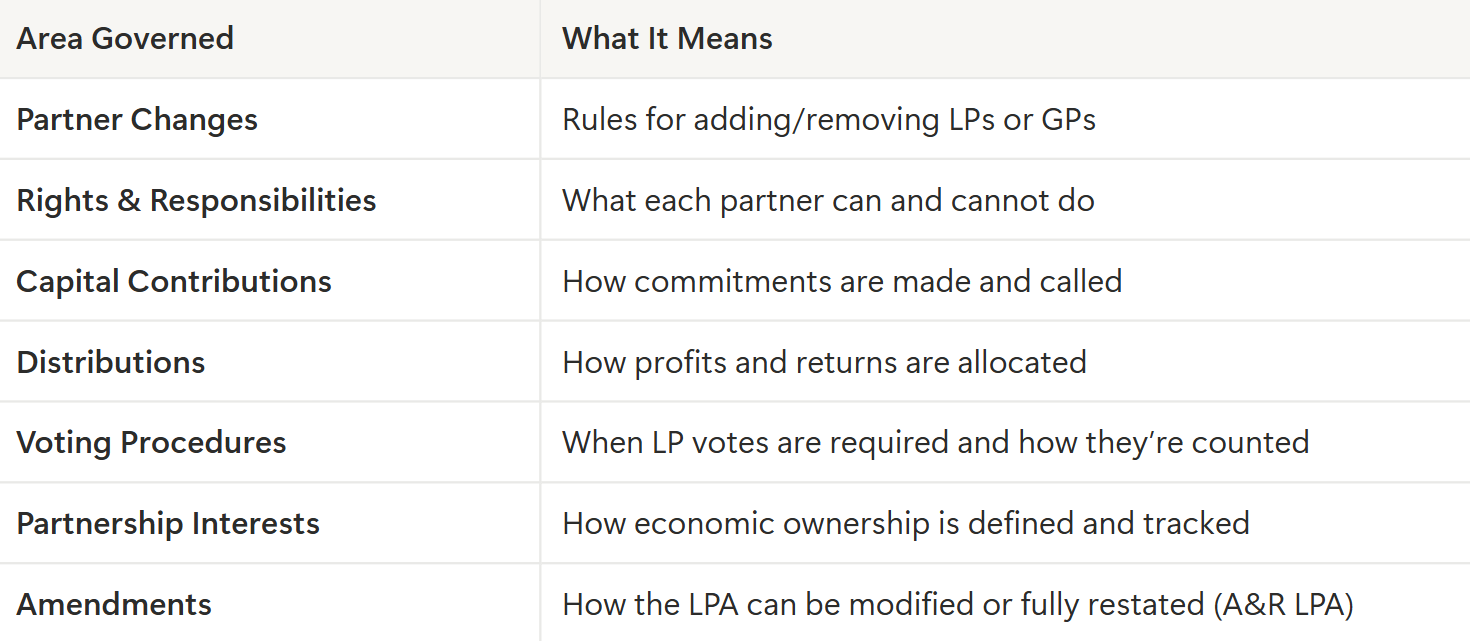

2. The Limited Partnership Agreement (LPA): The Fund’s Rulebook

Every partnership operates under a Limited Partnership Agreement (LPA) — essentially, the contract that governs how the fund works.

It defines:

- How new partners are added or removed

- Each partner’s rights and responsibilities

- How capital is contributed and distributed

- Voting procedures

- Economic ownership percentages (known as “partnership interests”)

Think of the LPA as the constitution of the fund. State law provides the default rules for partnerships, and the LPA modifies or supplements those defaults to define how the fund is managed.

As funds evolve, LPAs can be amended or restated — updated to reflect new terms or rewritten entirely for a new fund cycle (known as an Amended and Restated LPA, or A&R LPA).

What the LPA Governs (At a Glance)

3. LLCs: The Legal Home of the VC Firm

While the fund itself is usually a limited partnership, the venture firm behind it — the entity employing the investors — is almost always an LLC (Limited Liability Company).

An LLC offers: (IRS LLC Guide)

- Pass-through taxation (like a partnership)

- Limited liability protection for all members

- Flexibility in governance and ownership

The LLC’s terms are governed by an Operating Agreement, which functions much like an LPA but for the management company.

Most firms (even large, multi-fund platforms) create a new LLC for each fund’s GP entity. That means if one fund faces legal or financial issues, it doesn’t spill over into the others.

4. Why Everything Is in Delaware

If you’ve ever noticed that nearly every venture fund and startup is a Delaware entity, that’s no accident.

Delaware’s Court of Chancery has a long, detailed history of corporate law decisions, giving business owners and lawyers a high degree of legal predictability. It also offers:

- Efficient entity formation processes

- Business-friendly statutes

- A well-understood framework for partnerships and LLCs

Simply put, Delaware makes it easy to operate, modify, and enforce business structures — which is why most funds and startups start there.

5. How to Structure a Venture Firm and Fund (Step-by-Step)

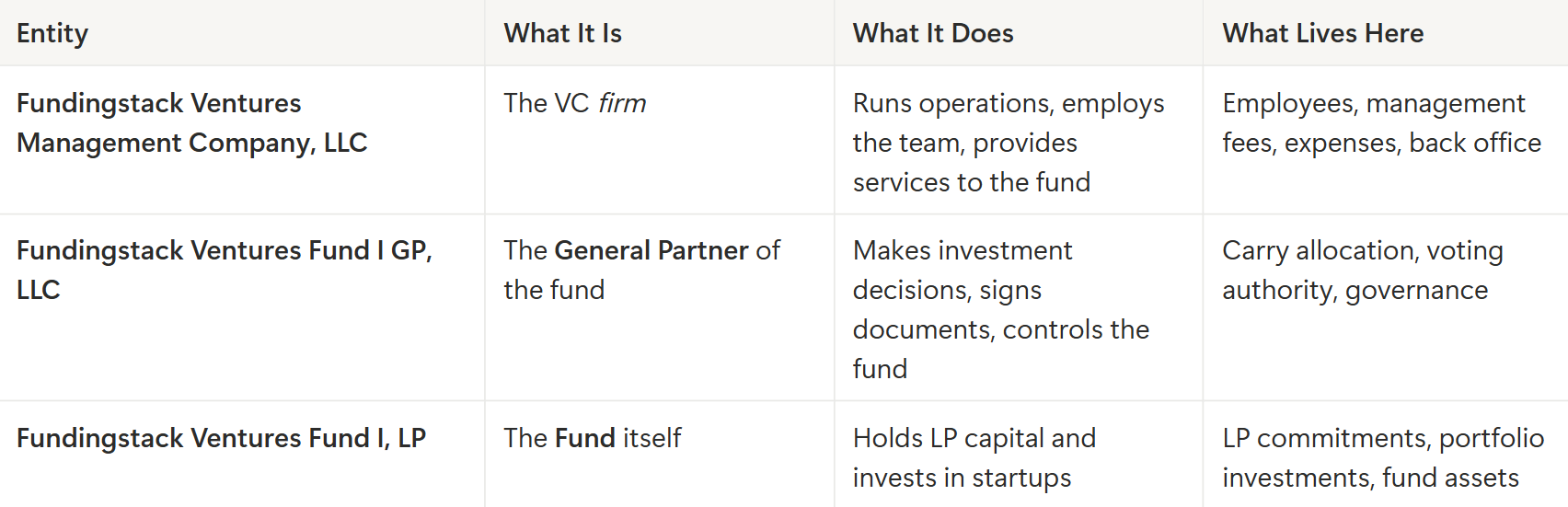

To see how all these entities fit together in real life, let’s walk through a simple example using a fictional first-time venture firm: Fundingstack Ventures.

They’re gearing up to launch their inaugural vehicle — Fundingstack Ventures Fund I — and here’s how they would structure it.

Step 1: Form the Management Company (LLC)

First, the partners create Fundingstack Ventures Management Company, LLC. This is the “business” behind the VC firm — the entity that employs the team, pays expenses, receives management fees, and handles day-to-day operations.

It also gives the team limited liability and pass-through taxation, which is why nearly every VC firm uses an LLC here.

Step 2: Create the Limited Partnership for the Fund

Next, they form Fundingstack Ventures Fund I, LP — the actual investment fund. This is where outside investors (LPs) commit capital. LPs stay passive and protected; Fundingstack Ventures makes the investment decisions.

Step 3: Form a GP Entity (Another LLC)

To run Fund I, Fundingstack Ventures forms a second LLC: Fundingstack Ventures Fund I GP, LLC. This entity acts as the general partner of the fund. Its job is to control and manage the fund — and to take on the liability that LPs don’t.

This structure keeps Fund I legally separated from future funds, which protects the firm as it grows.

Step 4: The GP Engages the Management Company

Since the GP entity has no employees, it enters into an agreement with Fundingstack Ventures Management Company, LLC. That management company provides all the investment, operations, back-office, and administrative support Fund I needs.

This model is standard across venture firms of all sizes.

Step 5: Finalize and Operate

With the structure in place:

- Fundingstack Ventures Management Company, LLC runs the business

- Fundingstack Ventures Fund I GP, LLC governs the fund

- Fundingstack Ventures Fund I, LP holds investor capital and makes investments

This setup also gives Fundingstack Ventures a clean foundation to launch future funds (Fund II, Fund III, etc.) without creating tax or liability headaches between them.

6. What You Actually Need to Set Up a VC Fund (Attorneys, Services, and Typical Costs)

Setting up a venture fund isn’t something you do alone — and knowing who to hire (and what it costs) helps first-time managers plan realistically.

1. Fund Formation Attorney (Required)

This is your core partner in setting up Fund I. They draft your LPA, operating agreements, subscription docs, and regulatory filings.

Typical players: boutique fund formation firms, specialized VC/PE attorneys, or emerging-manager–focused practices.

Typical cost range: $35k–$75k for a standard U.S. Fund I setup. Larger or multi-vehicle structures can run higher, but most emerging managers land here.

2. Compliance Specialist (Often Optional for Fund I)

For small funds, your attorney may handle compliance light-touch. But if you expect many LPs or ongoing regulatory obligations, a compliance consultant can help manage filings (Form ADV, blue sky, etc.).

Typical cost range: $3k–$10k annually depending on complexity.

3. Fund Administrator (Recommended)

Once you have LPs, you’ll need someone to handle capital calls, distributions, financial statements, and LP reporting.

Typical cost range:

Higher for larger or multi-fund platforms

$12k–$25k/year for lean emerging-manager funds

4. Tax + Audit Providers (Required Annually)

Your fund and management company each need tax returns. Many LPs (especially institutions) also require audited financials.

Typical cost range:

Audit: $12k–$25k annually (optional for many Fund I’s unless LP-required)

Tax prep: $3k–$10k per year per entity

The Key Takeaway

Fund structure may sound like paperwork, but it’s the foundation that makes venture capital work.

By understanding how LPs, GPs, and LLCs interact — and why Delaware is the default home for most funds — emerging managers can build firms that scale smoothly across multiple vehicles and investor bases.

Nathan Beckord is the CEO of Foundersuite.com & Fundingstack.com, which makes software for raising capital. Foundersuite and Fundingstack combined have helped entrepreneurs and VCs raise over $21 billion since 2016.